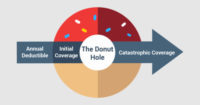

It’s the middle of the year and while you take a few medications, you wouldn’t consider yourself a person who takes a lot of prescriptions. But lo and behold you get a notice from Medicare and your insurance company, that you are in something referred to as a Coverage gap or “Donut Hole”. This means there is a temporary limit on what your drug plan will cover for drugs. Out of all the complicated terms in Medicare, the Coverage Gap or Donut Hole may be the most complicated of them all.

I’ll explain the best I can but just know, that most people won’t hit the coverage gap, ever. And there are steps you can take to make sure you stay out of it. I’ll mention those later.

According to Medicare.gov the Coverage gap is explained as, “The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. In 2016, once you and your plan have spent $3,310 on covered drugs, you’re in the coverage gap. This amount may change each year.” Let’s use an example here. Let’s say you take a drug called Simvastatin and with your drug plan you pay $6/month for it and let’s say the insurance company is paying $14, which comes to a total cost of $20. This $20 goes towards the Coverage gap figure of $3,310. As you can see, with low cost drugs, like Simvastatin, you most likely wouldn’t hit the Coverage gap. But if you had a more expensive Brand name drug, this could change the outcome. Assume you take a drug called Crestor. And lets assume you pay $45 with your insurance plan and the insurance company is paying $255 (this is just an example to make the numbers easy) then the total drug cost would be $300 and that number ($300) would go towards the Coverage gap. Crestor alone would get you into the Coverage gap around November ($300 x 11 months = $3,300) and if you are taking other medications, you would hit the gap even quicker.

Once you are in the Coverage gap, for 2016, brand name drugs like Crestor will cost you 45% of the plans cost with the pharmacy for that drug ($300 x .45 = $135). For generic medications, you will pay 58% in 2016. Using Simvastain’s full price of $20 example, you would pay $11.60.

If you are still with me and not confused yet, hold tight, it gets a little trickier.

Like I stated earlier, not everyone or many will hit the Coverage gap, but even fewer that actually get in to it, will get out of it into something called “Catastrophic Coverage”. To get to this stage you would have to do some more calculations. Crestor’s full cost in our example is $300 and during the Coverage gap you will pay $135, this $135 will count towards getting you to the next stage of Catastrophic Coverage PLUS you will add the 50% discount you are receiving from the manufacturer of $150. Which comes to $285 (your $135 + $150). The remaining $15 (5%) does NOT count towards the Catastrophic coverage. Even though you get to add in what you pay plus the manufacturer’s discount for Brand name drugs, this is not true for generic drugs. In the simvastin example, only the $11.60 would count towards getting into Catastrophic coverage. Once you add up all the drug cost you’ve spent, plus any discounts from manufacturer’s during the Coverage Gap and if that number reaches $4,850 in 2016, you will now be in Catastrophic Coverage and your cost will generally go way down.

Once you are in the Catastrophic stage, you will now only pay the greater of 5% or $2.95 for generics and the greater of 5% or $7.40 for all other drugs in 2016.

The Coverage Gap or “Donut Hole” is a lot of info to take in. You should be aware that you will receive a quarterly summary of all your drug cost for the year. Keep an eye on your Total Drug Cost to know if you are on track to get into the Coverage Gap.

There are ways to prevent yourself from getting or delaying the Coverage Gap. First, you can ask your doctor if there is a generic equivalent drug available if you are taking a Brand name drug. You should also keep up to date yearly during open enrollment (October 15 – December 7) to make sure your drug plan is best for you. Drug plans change often, and sometimes there are plans that will cover more for you during the Coverage gap. Also, you should check with your state to see if you qualify for Extra Help. If you do qualify financially, you will not be subject to the Coverage Gap and you may pay less for your drugs throughout the entire year.

If you have more questions, feel free to ask me by email or phone.

Chaz@SunCoastLegacyAdvisors.com

Florida 321-287-7331

Iowa 319-382-0743

Hey, I think your site might be having browser compatibility issues. When I look at your blog in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, terrific blog!

Thanks! I’ll check it out